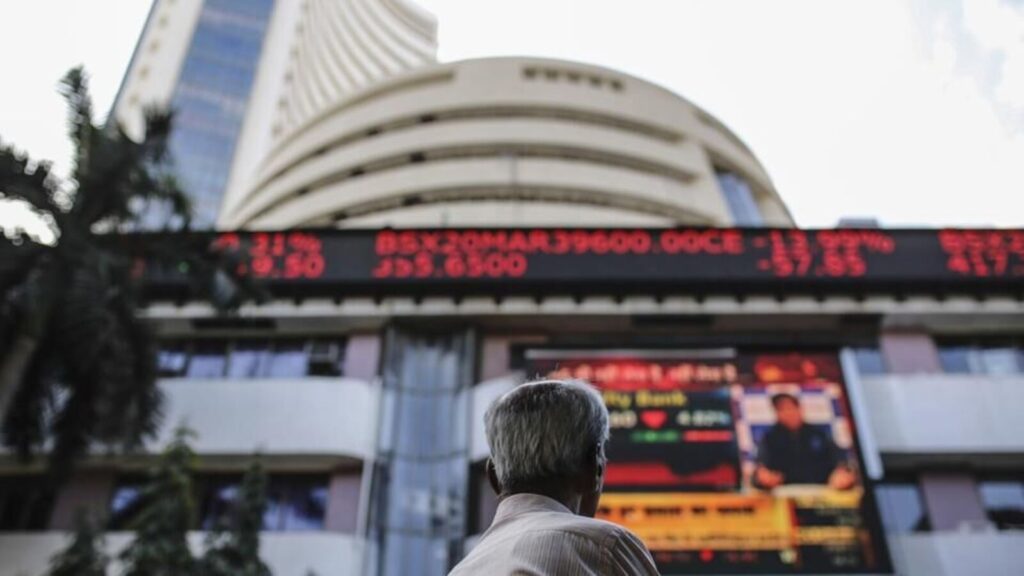

Indian stock market: The domestic equity market is expected to open higher on Thursday tracking positive cues from global peers.

Asian markets traded higher, while the US stock market ended mostly in the green overnight after data pointed to a softening economy, raising hopes for an interest rate cut by the US Federal Reserve in September.

Investors boosted bets of a September rate cut to over 70%, as per LSEG’s FedWatch.

On Wednesday, the Indian stock market ended with healthy gains, recording fresh closing high, with the benchmark Sensex breaching the coveted 80,000 mark for the first time ever, and the Nifty 50 crossing above 24,300 during the day.

The Sensex rallied 545.35 points, or 0.69%, to close at 79,986.80, while the Nifty 50 settled 162.65 points, or 0.67%, higher at 24,286.50.

“Strong institutional flows continue to support the market’s upward trend, suggesting sustained returns in the long term. However, the focus will likely shift to the upcoming budget and earnings reports next week, which may lead to short-term market consolidation,” said Naveen Kulkarni, Chief Investment Officer (CIO) at Axis Securities PMS.

Here are key global market cues for Sensex today:

Asian Markets

Asia markets traded higher on Thursday with Japan’s Topix crossing all-time high.

The Topix jumped 0.56%, while the Nikkei 225 rose 0.55%. South Korea’s Kospi rallied 0.98%, while the Kosdaq gained 0.75%. Hong Kong Hang Seng index futures indicated a higher opening.

Gift Nifty Today

Gift Nifty was trading around 24,460 level, a premium of nearly 95 points from the Nifty futures’ previous close, indicating a gap-up start for the Indian stock market indices.

Wall Street

US stock market indices ended mixed on Wednesday with the S&P 500 index and Nasdaq posting record high closes.

The Dow Jones Industrial Average fell 23.85 points, or 0.06%, to close at 39,308.00, while the S&P 500 rose 28.01 points, or 0.51%, to 5,537.02. The Nasdaq Composite ended 159.54 points, or 0.88%, higher at 18,188.30.

Tesla share price jumped 6.5%, Nvidia shares rallied 4.6%, while Amazon shares fell 1.2%. Paramount Global stock price surged almost 7%, while First Foundation shares plunged nearly 24%.

Fed Minutes

US Federal Reserve officials at their June meeting acknowledged the US economy appeared to be slowing and that “price pressures were diminishing”. However, Fed officials still counseled a wait-and-see approach before committing to interest rate cuts, according to minutes of the June 11-12 session.

US Services PMI

The measure of US services sector activity slumped to a four-year low in June. The Institute for Supply Management said its non-manufacturing purchasing managers (PMI) index dropped to 48.8 last month, the lowest level since May 2020, from 53.8 in May. Economists polled by Reuters had forecast the services PMI slipping to 52.5.

US Jobless Claims

The number of Americans filing new claims for unemployment benefits increased last week. Initial claims for state unemployment benefits rose 4,000 to a seasonally adjusted 238,000 for the week ended June 29. Economists polled by Reuters had forecast 235,000 claims in the latest week.

Factory Orders

New orders for US-manufactured goods unexpectedly fell in May. Factory orders dropped 0.5% after rising 0.4% in April. Economists polled by Reuters had forecast factory orders would gain 0.2%.

Oil Prices

Crude oil prices traded lower on Thursday after gaining a percent in the previous session.

Brent crude futures fell 0.39% to $87 a barrel, while US West Texas Intermediate (WTI) crude futures declined 0.42% to $83.53.

(With inputs from Reuters)

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.