Asian markets traded higher, while the US stock market closed in the green last week amid key economic data releases.

Markets are pricing in a 49.4% chance for a rate cut at the US Federal Reserve’s September meeting, down from 54.8% a week ago, CME’s FedWatch Tool showed.

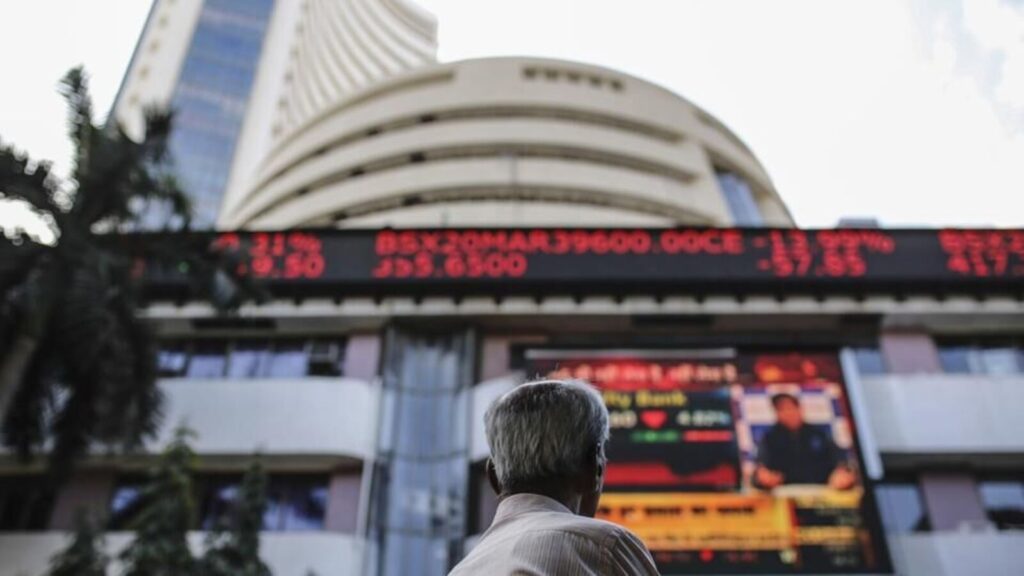

On Friday, the Indian stock market benchmark indices ended flat with a negative bias amid profit booking and weak global cues.

The Sensex eased 7.65 points, or 0.01%, to close at 75,410.39, while the Nifty 50 settled 10.55 points, or 0.05%, lower at 22,957.10.

“Easing in FII selling and healthy domestic macro data supported the positive sentiments in the market. Overall we expect the market to witness a gradual up-move and see some volatility next week as both election and earning season are nearing the end,” said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd.

Going ahead, investors will keenly watch the final batch of Q4 results, Lok Sabha election voter turnout, domestic and global macroeconomic data, foreign fund inflow, crude oil prices, and other key global cues.

Here are key global market cues for Sensex today:

Asian Markets

Asian markets traded higher on Monday ahead of key economic data from China and India later this week. MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.1%, having slipped 1.5% last week and away from a two-year peak.

Japan’s Nikkei 225 gained 0.39% and the Topix rose 0.4%. South Korea’s Kospi added 0.3%, while the Kosdaq gained 0.35%. Hong Kong’s Hang Seng index futures indicated a stronger open.

Gift Nifty Today

Gift Nifty was trading around the 23,030 level, a premium of nearly 15 points from the Nifty futures’ previous close, indicating a flat-to-positive positive start for the Indian stock market indices.

Also Read: Buy or sell: Vaishali Parekh recommends three stocks to buy today — May 27

Wall Street

The US stock market ended higher on Friday, with the Nasdaq recording a fifth straight week of gains and record closing high.

The Dow Jones Industrial Average gained 4.33 points, or 0.01%, to 39,069.59, while the S&P 500 rose 36.88 points, or 0.70%, to 5,304.72. The Nasdaq Composite closed 184.76 points, or 1.10%, higher at 16,920.79.

For the week, the Dow declined 2.34%, the S&P gained 0.03% and the Nasdaq rallied 1.41%.

Also Read: Wall Street week ahead: Investors’ focus on Fed preferred inflation gauge – core PCE index

Bank of Japan

The Bank of Japan (BOJ) will proceed cautiously with inflation-targeting frameworks, while estimating the neutral interest rate accurately is particularly challenging in Japan, given the prolonged period of near-zero short-term interest rates over the past three decades, Governor Kazuo Ueda said.

US Capital Goods Orders

New orders for US-manufactured non-defense capital goods excluding aircraft rose 0.3% in April after an upwardly revised 0.1% dip in March, the Commerce Department’s Census Bureau said. Economists polled by Reuters had forecast these capital goods orders would rise 0.1% after declining by a previously reported 0.2% in March.

Also Read: Top Stock Recommendations: Dharmesh Shah suggests buying these two stocks today

Consumer Inflation Sentiment

A University of Michigan survey showing US consumers’ inflation expectations improved in late May after deteriorating early in the month, Reuters reported. The survey’s 12-month inflation expectation fell to 3.3% from 3.5%. The five-year inflation outlook improved to 3.0% from 3.1% earlier this month.

Oil Prices

Crude oil prices steadied after its biggest weekly loss in four. Brent futures rose 0.13% to $82.23 a barrel after dropping 2.2% last week and touching the lowest since early February, while West Texas Intermediate (WTI) gained 0.17% to $77.85.

(With inputs from Reuters)

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.

You are on Mint! India’s #1 news destination (Source: Press Gazette). To learn more about our business coverage and market insights Click Here!

Download The Mint News App to get Daily Market Updates.

Published: 27 May 2024, 07:05 AM IST