Avanse Financial Services Ltd has filed its draft red herring prospectus (DRHP) with the capital market regulator, Securities and Exchange Board of India (SEBI), for an initial public offering (IPO).

Avanse Financial Services Limited is an Indian non-banking financial corporation (NBFC) with an emphasis on education. The company offers a complete stack education offering, according to the Crisil report, with products ranging from student education loans to expansion capital for educational institutions in the form of education infrastructure loans.

Draft Red Herring Prospectus (DRHP) states that Olive Vine Investment Ltd, a Warburg Pincus affiliate, is the company’s promoter. International Finance Corporation and affiliates of Kedaara Capital, Mubadala Investment Company, and Avendus Future are among the institutional shareholders.

Also Read: Ola Electric, Emcure Pharmaceuticals get SEBI nod for IPO launch

A fresh issuance of equity shares up to ₹1000 crore and an offer for sale (OFS) of up to ₹2500 crore by the “Selling Shareholder” with a face value of ₹5 per equity share make up the public offer, which has a combined total value of ₹3500 crore.

The offer for sale includes equity shares from Olive Vine Investment Ltd (Promoter Selling Shareholder) up to ₹1,758 crore; equity shares from International Finance Corporation (Investor Selling Shareholder)up to ₹342 crore; and equity shares from Kedaara Capital Growth Fund III LLP (Investor Selling Shareholder) up to ₹400 crore.

As of the date of the DRHP (June 20), the promoter holds 149,394,074 Equity Shares of face value of ₹5 each, comprising 58.38% of the pre-Offer issued, subscribed and paid-up equity share capital of the company on a fully diluted basis.

In order to satisfy the company’s future capital requirements resulting from the expansion of its business and asset base, Avanse Financial Services Limited plans to use the Net Proceeds to increase its capital base.

The book running lead managers for the issue are Kotak Mahindra Capital Company Limited, Avendus Capital Private Limited, J.P. Morgan India Private Limited, Nomura Financial Advisory and Securities (India) Private Limited, Nuvama Wealth Management Limited (previously known as Edelweiss Securities Limited), and SBI Capital Markets Limited.

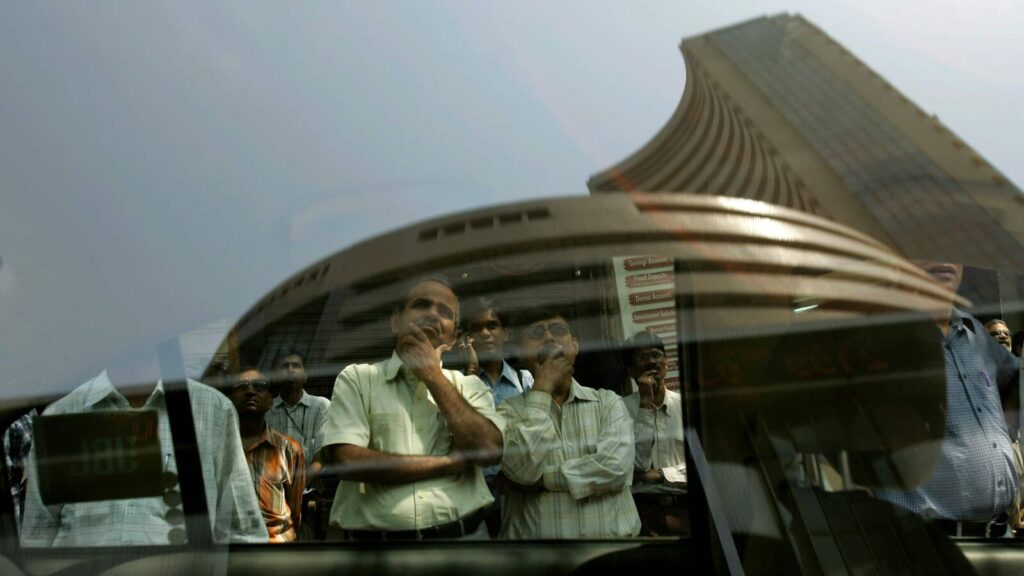

The equity shares are proposed to be listed on the BSE, and NSE.

Also Read: Zepto bags $665 mn ahead of IPO next year. Valuation doubles

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decisions.

3.6 Crore Indians visited in a single day choosing us as India’s undisputed platform for General Election Results. Explore the latest updates here!

Download The Mint News App to get Daily Market Updates.

Published: 21 Jun 2024, 12:29 PM IST